Design the Roadmap of Holistic Financial Inclusion for Baitul Maal wat Tamwil

DOI:

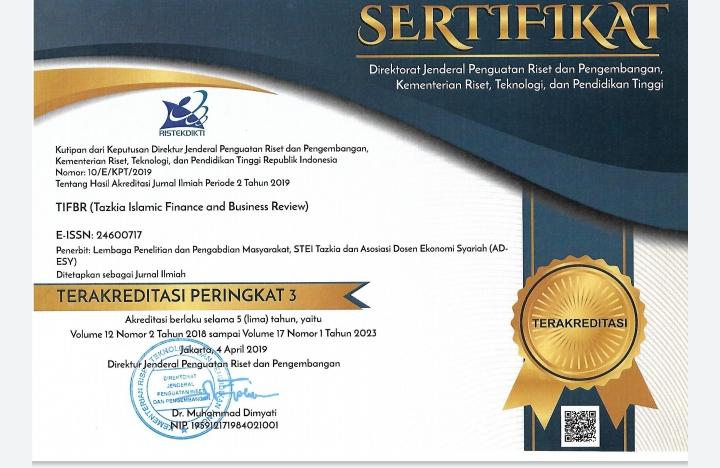

https://doi.org/10.30993/tifbr.v12i1.112Keywords:

Social Inclusion, Financial Inclusion, Holistic Financial Inclusion, Baitul Maal wat TamwilAbstract

This paper aims to design the roadmap of Holistic Financial Inclusion (HFI) by Baitul Maal wat Tamwil (BMT), where Baitul Maal carries out social inclusion and Baitut Tamwil carries out financial inclusion, using Analysis Network Process (ANP). The results show that the most important aspects of HFI are Sustainability, Development Program, Financing Program and Islamic Microfinance Services, while the most important elements of HFI are regular meeting, micro savings, simplicity and easy access, consumption smoothing, bailout debt, savings program and income increase, followed by funding independent, total deposits, mindset change, and micro financing. HFI of BMT could be developed gradually. At the first stage, BMT should have the minimum 16 elements of HFI comprising 4 (four) Social Inclusion elements, 4 (four) Financial Inclusion elements, 4 (four) Double bottom-Line elements and 4 (four) Welfare Impact elements. At the second stage, BMT should add the next 16 elements comprising 5 (five) Social Inclusion elements and 3 (three) Financial Inclusion elements, 5 (five) Double Bottom-Line elements and 3 (three) Welfare Impact elements. Moreover, at the third stage, the remaining 24 elements of HFI should be fulfilled. All Islamic financial institution must have the characteristic of HFI.References

Adnan, M., and Ajija, S. (2015). The Effectiveness of Baitul Maal wat Tamwil in Reducing Poverty. Humanomics, Vol. 31(2): 160-182.

Ahmed, H. (2002). Financing Microenterprises, An Analytical Study of Islamic Microfinance Institutions. Islamic Economic Studies, Vol. 31(2): 160-182.

Ahmed, H. (2013). Financial Inclusion and Islamic Finance, Organizational Formats, Products, Outreach and Sustainability. In Z. Iqbal, and A. Mirakhor (Eds.), Economic Development and Islamic Finance. Washington DC: World Bank Publication.

Alaeddin, O., and Anwar, N. (2012, November).Critical Analysis of Diverse Funding of Islamic Microfinance Institution, A Case Study in BMT Amanah Ummah Surabaya Indonesia. Paper presented at the 2nd ISRA Colloquium, Kuala Lumpur.

Alam, M., and Getubig, M. (2010). Guidelines for Establishing and Operating Grameen-Style Microcredit Programs, Based on the Practices of Grameen Bank and the Experiences of Gramees Trust and Grameen Foundation Partners. USA: Grameen Foundation.

Ali, A. E. E. S. (2014). Islamic Microfinance, Moving Beyond Financial Inclusion (Working Paper 1435-11). IRTI.

Ali, M. K. (2014b). Integrating Zakah, Awqaf and Islamic Microfinance for Poverty Alleviation, Three Models of Islamic Micro Finance (Working Paper Series1435-19). IRTI.

Alpay, S. (2011, May). Enhancing employability in OIC Countries, The Role of Capacity Building and Microfinance. Paper presented at the Meeting on Addressing Unemployment in the IDB Member Countries in the Post-Crisis World. IDB Group: Jeddah.

An-Nawawi, Y. (2001). Riyadu as-Solihin. Beirut: Muassasah Ar-Risalah.

Armendariz, B., and Morduch, J. (2010). The Economics of Microfinance (2nd Ed.). London: The MIT Press.

Armendariz, B., D’Espallier, B., Hudon, M., andSzafarz, A. (2013). Subsidy Uncertainty and Microfinance Mission Drift (CEB Working Paper11).

Ascarya. (2014). Sustainable Conventional and Islamic Microfinance Models for Micro Enterprises. ISRA International Journal of Islamic Finance, Vol. 6(2): 49-85.

Ascarya, and Cahyono, W. (2011). Comparing the Sustainability of Conventional and Islamic Microfinance and Models in Indonesia”, paper presented at the Political Economy of Trade Liberalization in Developing East Asia, Sustainability, Governance, and the Role of Small Business. Malang: University of Brawijaya.

Atnafu, H. (2010). How Efficiently are the Ethiopian MFIs Extending Financial Services to the Poor? A Comparison with the Commercial Banks (Master Thesis). Addis Ababa University.

Bank Indonesia. (2012). Kodifikasi Peraturan Bank Indonesia Kelembagaan Penilaian Tingkat Kesehatan Bank. Jakarta: Bank Indonesia.

Bank Indonesia. (2014). Booklet Financial Inclusion. Jakarta: Bank Indonesia.

Beck, T., and Hesse, H. (2006). Bank efficiency, Ownership and Market Structure Why Are Interest Spreads So High in Uganda? (Discussion Paper Series 277). Department of Economics, University of Oxford.

Beik, I. S., and Arsyanti, L. D. (2015). Construction of CIBEST Model as Measurement of Poverty and Welfare Indices from Islamic Perspective. Journal Al-Iqtishad, Vol. 7(1): 88-104.

Bhatt, N., and Tang, S. (2001). Delivering Microfinance in Developing Countries, Controversies and Policy Perspectives. Policy Studies Journal, Vol. 29(2): 319-333.

Bogan, V., Johnson, W., and Mhlanga, N. (2007). Does Capital Structure Affect the Financial Sustainability of Microfinance Institutions? (Working paper). Department of Applied Economics and Management, Cornell University.

Bremer, J. (2014, May). Zakat and Economic Justice, Emerging International Models and Their Relevance for Economic Growth. Paper presented at World Zakat Forum, WZF: New York.

Campion, A. (2000). Improving Internal Control, A Practical Guide for Microfinance Institutions. Washington DC: ACCION.

Centre for the Study of Financial Innovation (CSFI). (2014). Microfinance Banana Skins 2014. London: CSFI.

Charitonenko, S., and Afwan, I. (2003).Commercialization of Microfinance, Indonesia. Manila: Asian Development Bank.

Cokro, W. M., and Ismail, A. G. (2008). Sustainability of BMT Financing for Developing Micro-enteprises. MPRA Paper, 7434.

Consultative Group to Assist the Poor (CGAP). (2006). Good Practice Guidelines for Funders of Microfinance (2nd Edition). Washington DC: CGAP.

Consultative Group to Assist the Poor (CGAP). (2003). Definitions of Selected Financial Terms, Ratios, and Adjustments for Microfinance (3rd edition). Washington DC: CGAP.

Cull, R., Demirgüç-Kunt, A., and Morduch, J. (2007). Financial Performance and Outreach, A Global Analysis of Leading Microbanks. The Economic Journal, Vol. 117(517). F107-F133.

Cull, R., Demirgüç-Kunt, A., and Morduch, J. (2008). Microfinance Meets the Market. Policy Research Working Paper, Vol. 4630: 1-38.

Demirgüç-Kunt, A., and Klapper, L. (2013). Measuring Financial Inclusion, Explaining Variation in Use of Financial Services across and within Countries. Brookings Papers on Economic Activity, 279-321.

Demirgüç-Kunt, A., Beck, T., and Honohan, P. (2008). Finance for All, Policies and Pitfalls in Expanding Access. Washington DC: World Bank.

Edgcomb, E. L. (2001). Assessment Tools for Microenterprise Training and Technical Assistance. Washington, DC: The Aspen Institute.

Evans, A. C., and Branch, B. (2002). A Technical Guide to PEARLS, A Performance Monitoring System. Madison: World Council of Credit Unions, Inc.

Farooq, M., and Khan, Z. (2014). The Social and Financial Performance of Conventional and Islamic Microfinance Institutions in Pakistan. Al-Idah,Vol. 28: 17-35.

Fehr, D., and Hishigsuren, G. (2004). Raising Capital for Microfinance, Sources of Funding and Opportunities for Equity Financing (CFS Working Paper 2004-01). Center for Financial Studies-Southern New Hampshire University.

Frank, C., and Lynch, E. (2008). Stemming the Tide of Mission Drift, Microfinance Transformations and the Double Bottom Line. New York: Women’s World Banking Focus Note.

Ghosh, S., and Tassel, E. V. (2008). A Model of Mission Drift in Microfinance Institution. Department of Economics, Florida Atlantic University.

Global Islamic Finance Report. (2012). Global Islamic Microfinance Landscape. In H. Dar et al. (Eds.), Global Islamic Finance Report 2012 (London, Edbiz Consulting Limited: 183-204).

Global Partnership for Financial Inclusion (GPFI). (2011). Global Standard-Setting Bodies and Financial Inclusion for the Poor, Toward Proportionate Standards and Guidance. GPFI White Paper.

Hadisumarto, W. B. M. C. and Ismail, A. G. B. (2010). Improving the Effectiveness of Islamic Micro-financing. Humanomics, Vol. 26(1): 65-75.

Hassan, M. K., and Ashraf, A. (2010). An Integrated Poverty Alleviation Model Combining Zakat, Awqaf and Micro-Finance. M. H. A. G. Ismail (Ed.) The Seventh International Conference – The Tawhidi Epistemology, Zakat and Waqf Economy (pp. 261-281). Institut Islam Hadhari,

Universiti Kebangsaan Malaysia, Bangi, Malaysia.

Hermes, N., and Lensink, R. (2011). Microfinance, Its Impact, Outreach, and Sustainability. World Development, Vol. 39(6): 875-881.

Hermes, N., Lensink, R., and Meesters, A. (2008). Outreach and Efficiency of Microfinance Institutions. University of Groningen: Faculty of Economics and Business.

Hoque, N., Khan, M. A., and Mohammad, K. D. (2015). Poverty Alleviation by Zakah in a Transitional Economy, A Small Business Entrepreneurial Framework. Journal of Global Entrepreneurship Research, Vol. 5(7): 1-20.

Hoque, N., Mamun, A., and Mamun, A. M. A. (2014). Dynamics and Traits of Entrepreneurship, An Islamic Approach. World Journal of Entrepreneurship, Management and Sustainable Development, Vol. 10(2): 128-142.

International Finance Corporation. (2014), Islamic Banking Opportunities across Small and Medium Enterprises in MENA. Washington DC: International Finance Corporation.

International Fund for Agricultural Development (IFAD). (2006). Assessing and Managing Social Performance in Microfinance. Rome: IFAD.

Iqbal, Z. (2014, June). Enhancing Financial Inclusion through Islamic Finance. Paperpresented at Financial Inclusion Conference, World Bank, Istanbul.

Iqbal, Z., and Mirakhor, A. (2012). Financial Inclusion, Islamic Finance Perspective. Journal of Islamic Business and Management, Vol. 2(1): 35-64.

Iqbal, Z., and Mirakhor, A. (2013). Islam’s Perspective on Financial Inclusion. Z. Iqbal, and A. Mirakhor. Economic Development and Islamic Finance, 179-200). Washington DC: World Bank Publications.

Islamic Research and Training Institute and Thomson Reuters. (2014). Islamic Social Finance Report 2014. IRTI and Thomson Reuters.

Jariya, A. M. (2013). True Economy Prosperity through Poverty Alleviation – Islamic Microfinance as Commercial Venture. International Journal of Business, Economic and Law, Vol. 2(2): 49-53.

Juwaini, A., et al. (2010, May). BMT (Baitul Maal wa Tamwil) Islamic Micro Financial Services for the Poor. Paper presented at the ISO/COPOLCO Workshop, Bali.

Kahf, M. (2002). Role of Zakah and Awqaf in Reducing Poverty, A Proposed Institutional Setting within the Spirit of Shari’ah”, Thoughts on Economics, Vol. 18(3): 39-67.

Kar, A. K. (2010). Sustainability and Mission Drift in Microfinance.

Helshinki, Hanken School of Economics.

Khadijah, S. A., et al. (2013). Sustainability of Islamic Micro Finance Institutions (IMFIs). Universal Journal of Accounting and Finance, Vol. 1(2): 70-77.

Khandker, S. R. (2003). Micro-Finance and Poverty, Evidence Using Panel

Data from Bangladesh. (Policy Research Working Paper 2945), World Bank.

Ledgerwood, J. (1999). Microfinance Handbook, An Institutional and Financial Perspective. Washington DC: World Bank.

Leyshon, A., and Thrift, N. (1995). Geographies of Financial Exclusion, Financial Abandonment in Britain and the United States. Transactions of the Institute of British Geographers, Vol. 20(3): 312-341.

Littlefield, E., Morduch, J., and Hashemi, S. (2003). Is Microfinance an Effective Strategy to Reach the Millenium Development Goals. Focus Note of CGAP 24.

M Alfriska, M., and Haryani, S. (2011). Regional Development Banks Performance in Indonesia. Proceedings of the First International Credit Union Conference on Social Microfinance and Community Development (pp. 91-94).Jakarta: BKCU Kalimantan and Gunadarma University.

MicroRate. (2014). Technical Guide, Performance and Social Indicators for Microfinance Institutions. Washington DC: MicroRate.

Mohieldin, M., et al. (2012). The Role of Islamic Finance in Enhancing Financial Inclusion in Organization of Islamic Cooperation (OIC) Countries. Islamic Economic Studies, Vol. 20(2): 55-120.

Morduch, J. (2000). The Microfinance Schism. World Development, Vol. 28(4): 617-629.

Naceur, S. B., Barajas, A., and Massara, A. (2015). Can Islamic Banking Increase Financial Inclusion? IMF Working Paper [15/31].

Natilson, N., and Bruett, T. (2001). Financial Performance Monitoring, A Guide for Board Members of Microfinance Institutions. Bethesda: Development Alternatives, Inc.

Nazirwan, M. (2015). The Dynamic Role and Performance of Baitul Maal Wat Tamwil, Islamic Community-Based Microfinance in Central Java (Doctoral Dissertation). Victoria University.

Njuguna, A. G. (2012). Critical Success Factors for a Micro-Pension Plan, an Exploratory Study. International Journal of Financial Research, Vol. 3(4): 82-97.

Obaidullah, M. (2008). Introduction to Islamic Finance. New Delhi: IBF Net Limited, India.

Obaidullah, M. (2008). Role of Microfinance in Poverty Alleviation. Jeddah: IRTI-IDB.

Obaidullah, M., and Khan, T. (2008). Islamic Microfinance Development, Challenges and Initiatives. Dialogue Paper Policy Dialogue Paper 2. Saudi Arabia: Islamic Research and Training Institute-Islamic Development Bank.

OECD. (2012). The Role of Empowerment for Poverty Reduction and Growth. Policy Guidance Note. Retrieved November 11, 2015.

Pitt, M. M., and Khandker, S. R. (1998). The Impact of Group-Based Credit Programs on Poor Households in Bangladesh, Does the Gender of Participants Matter?. Journal of Political Economy, Vol. 106(5): 958-996.

Rahman, A. (2013). Financial Inclusion as Tool for Combating Poverty. Bangladesh Bank.

Rahman, R. A., and Dean, F. (2013). Challenges and Solutions in Islamic Microfinance. Humanomics, Vol. 29(4): 293-306.

Reyes, G. P. (2010).Financial Inclusion Indicators for Developing Countries, The Peruvian Case. Peru: Superintendency of Banking.

Rhyne, E. (2009). Microfinance for Bankers and Investors, Understanding the Opportunity at the Bottom of the Pyramid. New York: McGraw-Hill.

Robinson, M. S. (2001). The Microfinance Revolution, Sustainable Finance for the Poor. Washington DC: World Bank.

Rokhman, W. (2013). Baitul Mal Wat Tamwil (BMT) and Poverty Alleviation. Qudus International Journal of Islamic Studies, Vol. 1(2): 181-196.

Rosenberg, R. (2009). Measuring Results of Microfinance Institutions, Minimum Indicators that Donors and Investors Should Track. Washington DC: The World Bank.

Rusydiana, A. S., and Devi, A. (2013). Challenges in Developing Baitul Maal Wat Tamwil (BMT) in Indonesia Using Analytical Network Process (ANP). Business and Management Quarterly Review, Vol. 4(2): 51-62.

Saaty, TL. (2005), Theory and Applications of the Analytic Network Process, Decision Making with Benefits, Opportunities, Costs and Risks. Pittsburgh: RWS Publications.

Saaty, TL and Vargas, LG. (2006). Decision Making with the Analytic Network Process, Economic, Political, Social and Technological Applications with Benefits, Opportunities, Costs and Risks. New York: Springer Science + Business Media.

Saha, S. (2011). Provision of Health Services for Microfinance Clients, Analysis of Evidence from India. International Journal Medical Public Health, Vol. 1(1):1-5.

Sarma, M., andPais, J. (2008).Financial Inclusion and Development, A Cross Country Analysis. New Delhi: Madras Schools of Economics.

Seibel, H. D. (2005). Islamic Microfinance in Indonesia. Sector Project Financial Systems Development. Eschborn: Deutsche Gesellschaftfür Technische Zusammenarbeit.

Shirazi, N. S. (2012). Targeting and Socio-Economic Impact of Microfinance, A Case Study of Pakistan (Working Paper 1433-02). Islamic Research and Training Institute.

Stauffenberg, D. V., et al. (2003). Performance Indicators for Microfinance Institutions, Technical Guide. Washington DC: Inter-American Development Bank.

Tamanni, L., and Liu, F. H. (2015, September). Islamic Microfinance Institutions, Pro-Poor or Profit?. Paper presented at the Inaugural Symposium on Islamic Finance, World Bank and Islamic Development Bank, Istanbul.

Tamanni, L., and Mukhlisin, M. (2013). Sakinah Finance, Solusi Mudah Mengatur Keuangan Keluarga Islami. Solo: Tinta Medina.

Tucker, M. (2001). Financial Performance of Selected Microfinance Institutions, Benchmarking Progress to Sustainability. Journal of Microfinance, Vol. 3(2): 107-123.

Widiarto, I., and Emrouznejad, A. (2015). Social and Financial Efficiency of Islamic Microfinance Institutions, A Data Development Analysis Application. Socio-Economic Planning Sciences, Vol. 50: 1-17.

World Bank. (2013). Inclusion Matters, The Foundation for Shared Prosperity (Advance edition). Washington DC: World Bank.

Yanah. (2014). Strategi Pengentasan Kemiskinan di Indonesia melalui Sinergi antara Bank Syariah dan BAZNAS. Jurnal Ekonomi, Vol. 2(3): 1-33.

Yunus, M. (2004). Grameen Bank, Microcredit, and Millenium Development Goals. Economic and Political Weekly, Vol. 39(36): 4077-4085.

Yuqing, C. (2007). Can Microfinance Change the Lives of the Poor in

China? (Reuters Fellowship Paper). Oxford University.

Zada, N., and Saba, I. (2013). The Potential Use of Qard Hasan in Islamic Microfinance”, ISRA International Journal of Islamic Finance, Vol. 5(2): 153-162.

Zeller, Z., and Meyer, R. L. (2002).The Triangle of Microfinance, Financial Sustainability, Outreach and Impact. London: The John Hopkins University Press.

Ahmed, H. (2002). Financing Microenterprises, An Analytical Study of Islamic Microfinance Institutions. Islamic Economic Studies, Vol. 31(2): 160-182.

Ahmed, H. (2013). Financial Inclusion and Islamic Finance, Organizational Formats, Products, Outreach and Sustainability. In Z. Iqbal, and A. Mirakhor (Eds.), Economic Development and Islamic Finance. Washington DC: World Bank Publication.

Alaeddin, O., and Anwar, N. (2012, November).Critical Analysis of Diverse Funding of Islamic Microfinance Institution, A Case Study in BMT Amanah Ummah Surabaya Indonesia. Paper presented at the 2nd ISRA Colloquium, Kuala Lumpur.

Alam, M., and Getubig, M. (2010). Guidelines for Establishing and Operating Grameen-Style Microcredit Programs, Based on the Practices of Grameen Bank and the Experiences of Gramees Trust and Grameen Foundation Partners. USA: Grameen Foundation.

Ali, A. E. E. S. (2014). Islamic Microfinance, Moving Beyond Financial Inclusion (Working Paper 1435-11). IRTI.

Ali, M. K. (2014b). Integrating Zakah, Awqaf and Islamic Microfinance for Poverty Alleviation, Three Models of Islamic Micro Finance (Working Paper Series1435-19). IRTI.

Alpay, S. (2011, May). Enhancing employability in OIC Countries, The Role of Capacity Building and Microfinance. Paper presented at the Meeting on Addressing Unemployment in the IDB Member Countries in the Post-Crisis World. IDB Group: Jeddah.

An-Nawawi, Y. (2001). Riyadu as-Solihin. Beirut: Muassasah Ar-Risalah.

Armendariz, B., and Morduch, J. (2010). The Economics of Microfinance (2nd Ed.). London: The MIT Press.

Armendariz, B., D’Espallier, B., Hudon, M., andSzafarz, A. (2013). Subsidy Uncertainty and Microfinance Mission Drift (CEB Working Paper11).

Ascarya. (2014). Sustainable Conventional and Islamic Microfinance Models for Micro Enterprises. ISRA International Journal of Islamic Finance, Vol. 6(2): 49-85.

Ascarya, and Cahyono, W. (2011). Comparing the Sustainability of Conventional and Islamic Microfinance and Models in Indonesia”, paper presented at the Political Economy of Trade Liberalization in Developing East Asia, Sustainability, Governance, and the Role of Small Business. Malang: University of Brawijaya.

Atnafu, H. (2010). How Efficiently are the Ethiopian MFIs Extending Financial Services to the Poor? A Comparison with the Commercial Banks (Master Thesis). Addis Ababa University.

Bank Indonesia. (2012). Kodifikasi Peraturan Bank Indonesia Kelembagaan Penilaian Tingkat Kesehatan Bank. Jakarta: Bank Indonesia.

Bank Indonesia. (2014). Booklet Financial Inclusion. Jakarta: Bank Indonesia.

Beck, T., and Hesse, H. (2006). Bank efficiency, Ownership and Market Structure Why Are Interest Spreads So High in Uganda? (Discussion Paper Series 277). Department of Economics, University of Oxford.

Beik, I. S., and Arsyanti, L. D. (2015). Construction of CIBEST Model as Measurement of Poverty and Welfare Indices from Islamic Perspective. Journal Al-Iqtishad, Vol. 7(1): 88-104.

Bhatt, N., and Tang, S. (2001). Delivering Microfinance in Developing Countries, Controversies and Policy Perspectives. Policy Studies Journal, Vol. 29(2): 319-333.

Bogan, V., Johnson, W., and Mhlanga, N. (2007). Does Capital Structure Affect the Financial Sustainability of Microfinance Institutions? (Working paper). Department of Applied Economics and Management, Cornell University.

Bremer, J. (2014, May). Zakat and Economic Justice, Emerging International Models and Their Relevance for Economic Growth. Paper presented at World Zakat Forum, WZF: New York.

Campion, A. (2000). Improving Internal Control, A Practical Guide for Microfinance Institutions. Washington DC: ACCION.

Centre for the Study of Financial Innovation (CSFI). (2014). Microfinance Banana Skins 2014. London: CSFI.

Charitonenko, S., and Afwan, I. (2003).Commercialization of Microfinance, Indonesia. Manila: Asian Development Bank.

Cokro, W. M., and Ismail, A. G. (2008). Sustainability of BMT Financing for Developing Micro-enteprises. MPRA Paper, 7434.

Consultative Group to Assist the Poor (CGAP). (2006). Good Practice Guidelines for Funders of Microfinance (2nd Edition). Washington DC: CGAP.

Consultative Group to Assist the Poor (CGAP). (2003). Definitions of Selected Financial Terms, Ratios, and Adjustments for Microfinance (3rd edition). Washington DC: CGAP.

Cull, R., Demirgüç-Kunt, A., and Morduch, J. (2007). Financial Performance and Outreach, A Global Analysis of Leading Microbanks. The Economic Journal, Vol. 117(517). F107-F133.

Cull, R., Demirgüç-Kunt, A., and Morduch, J. (2008). Microfinance Meets the Market. Policy Research Working Paper, Vol. 4630: 1-38.

Demirgüç-Kunt, A., and Klapper, L. (2013). Measuring Financial Inclusion, Explaining Variation in Use of Financial Services across and within Countries. Brookings Papers on Economic Activity, 279-321.

Demirgüç-Kunt, A., Beck, T., and Honohan, P. (2008). Finance for All, Policies and Pitfalls in Expanding Access. Washington DC: World Bank.

Edgcomb, E. L. (2001). Assessment Tools for Microenterprise Training and Technical Assistance. Washington, DC: The Aspen Institute.

Evans, A. C., and Branch, B. (2002). A Technical Guide to PEARLS, A Performance Monitoring System. Madison: World Council of Credit Unions, Inc.

Farooq, M., and Khan, Z. (2014). The Social and Financial Performance of Conventional and Islamic Microfinance Institutions in Pakistan. Al-Idah,Vol. 28: 17-35.

Fehr, D., and Hishigsuren, G. (2004). Raising Capital for Microfinance, Sources of Funding and Opportunities for Equity Financing (CFS Working Paper 2004-01). Center for Financial Studies-Southern New Hampshire University.

Frank, C., and Lynch, E. (2008). Stemming the Tide of Mission Drift, Microfinance Transformations and the Double Bottom Line. New York: Women’s World Banking Focus Note.

Ghosh, S., and Tassel, E. V. (2008). A Model of Mission Drift in Microfinance Institution. Department of Economics, Florida Atlantic University.

Global Islamic Finance Report. (2012). Global Islamic Microfinance Landscape. In H. Dar et al. (Eds.), Global Islamic Finance Report 2012 (London, Edbiz Consulting Limited: 183-204).

Global Partnership for Financial Inclusion (GPFI). (2011). Global Standard-Setting Bodies and Financial Inclusion for the Poor, Toward Proportionate Standards and Guidance. GPFI White Paper.

Hadisumarto, W. B. M. C. and Ismail, A. G. B. (2010). Improving the Effectiveness of Islamic Micro-financing. Humanomics, Vol. 26(1): 65-75.

Hassan, M. K., and Ashraf, A. (2010). An Integrated Poverty Alleviation Model Combining Zakat, Awqaf and Micro-Finance. M. H. A. G. Ismail (Ed.) The Seventh International Conference – The Tawhidi Epistemology, Zakat and Waqf Economy (pp. 261-281). Institut Islam Hadhari,

Universiti Kebangsaan Malaysia, Bangi, Malaysia.

Hermes, N., and Lensink, R. (2011). Microfinance, Its Impact, Outreach, and Sustainability. World Development, Vol. 39(6): 875-881.

Hermes, N., Lensink, R., and Meesters, A. (2008). Outreach and Efficiency of Microfinance Institutions. University of Groningen: Faculty of Economics and Business.

Hoque, N., Khan, M. A., and Mohammad, K. D. (2015). Poverty Alleviation by Zakah in a Transitional Economy, A Small Business Entrepreneurial Framework. Journal of Global Entrepreneurship Research, Vol. 5(7): 1-20.

Hoque, N., Mamun, A., and Mamun, A. M. A. (2014). Dynamics and Traits of Entrepreneurship, An Islamic Approach. World Journal of Entrepreneurship, Management and Sustainable Development, Vol. 10(2): 128-142.

International Finance Corporation. (2014), Islamic Banking Opportunities across Small and Medium Enterprises in MENA. Washington DC: International Finance Corporation.

International Fund for Agricultural Development (IFAD). (2006). Assessing and Managing Social Performance in Microfinance. Rome: IFAD.

Iqbal, Z. (2014, June). Enhancing Financial Inclusion through Islamic Finance. Paperpresented at Financial Inclusion Conference, World Bank, Istanbul.

Iqbal, Z., and Mirakhor, A. (2012). Financial Inclusion, Islamic Finance Perspective. Journal of Islamic Business and Management, Vol. 2(1): 35-64.

Iqbal, Z., and Mirakhor, A. (2013). Islam’s Perspective on Financial Inclusion. Z. Iqbal, and A. Mirakhor. Economic Development and Islamic Finance, 179-200). Washington DC: World Bank Publications.

Islamic Research and Training Institute and Thomson Reuters. (2014). Islamic Social Finance Report 2014. IRTI and Thomson Reuters.

Jariya, A. M. (2013). True Economy Prosperity through Poverty Alleviation – Islamic Microfinance as Commercial Venture. International Journal of Business, Economic and Law, Vol. 2(2): 49-53.

Juwaini, A., et al. (2010, May). BMT (Baitul Maal wa Tamwil) Islamic Micro Financial Services for the Poor. Paper presented at the ISO/COPOLCO Workshop, Bali.

Kahf, M. (2002). Role of Zakah and Awqaf in Reducing Poverty, A Proposed Institutional Setting within the Spirit of Shari’ah”, Thoughts on Economics, Vol. 18(3): 39-67.

Kar, A. K. (2010). Sustainability and Mission Drift in Microfinance.

Helshinki, Hanken School of Economics.

Khadijah, S. A., et al. (2013). Sustainability of Islamic Micro Finance Institutions (IMFIs). Universal Journal of Accounting and Finance, Vol. 1(2): 70-77.

Khandker, S. R. (2003). Micro-Finance and Poverty, Evidence Using Panel

Data from Bangladesh. (Policy Research Working Paper 2945), World Bank.

Ledgerwood, J. (1999). Microfinance Handbook, An Institutional and Financial Perspective. Washington DC: World Bank.

Leyshon, A., and Thrift, N. (1995). Geographies of Financial Exclusion, Financial Abandonment in Britain and the United States. Transactions of the Institute of British Geographers, Vol. 20(3): 312-341.

Littlefield, E., Morduch, J., and Hashemi, S. (2003). Is Microfinance an Effective Strategy to Reach the Millenium Development Goals. Focus Note of CGAP 24.

M Alfriska, M., and Haryani, S. (2011). Regional Development Banks Performance in Indonesia. Proceedings of the First International Credit Union Conference on Social Microfinance and Community Development (pp. 91-94).Jakarta: BKCU Kalimantan and Gunadarma University.

MicroRate. (2014). Technical Guide, Performance and Social Indicators for Microfinance Institutions. Washington DC: MicroRate.

Mohieldin, M., et al. (2012). The Role of Islamic Finance in Enhancing Financial Inclusion in Organization of Islamic Cooperation (OIC) Countries. Islamic Economic Studies, Vol. 20(2): 55-120.

Morduch, J. (2000). The Microfinance Schism. World Development, Vol. 28(4): 617-629.

Naceur, S. B., Barajas, A., and Massara, A. (2015). Can Islamic Banking Increase Financial Inclusion? IMF Working Paper [15/31].

Natilson, N., and Bruett, T. (2001). Financial Performance Monitoring, A Guide for Board Members of Microfinance Institutions. Bethesda: Development Alternatives, Inc.

Nazirwan, M. (2015). The Dynamic Role and Performance of Baitul Maal Wat Tamwil, Islamic Community-Based Microfinance in Central Java (Doctoral Dissertation). Victoria University.

Njuguna, A. G. (2012). Critical Success Factors for a Micro-Pension Plan, an Exploratory Study. International Journal of Financial Research, Vol. 3(4): 82-97.

Obaidullah, M. (2008). Introduction to Islamic Finance. New Delhi: IBF Net Limited, India.

Obaidullah, M. (2008). Role of Microfinance in Poverty Alleviation. Jeddah: IRTI-IDB.

Obaidullah, M., and Khan, T. (2008). Islamic Microfinance Development, Challenges and Initiatives. Dialogue Paper Policy Dialogue Paper 2. Saudi Arabia: Islamic Research and Training Institute-Islamic Development Bank.

OECD. (2012). The Role of Empowerment for Poverty Reduction and Growth. Policy Guidance Note. Retrieved November 11, 2015.

Pitt, M. M., and Khandker, S. R. (1998). The Impact of Group-Based Credit Programs on Poor Households in Bangladesh, Does the Gender of Participants Matter?. Journal of Political Economy, Vol. 106(5): 958-996.

Rahman, A. (2013). Financial Inclusion as Tool for Combating Poverty. Bangladesh Bank.

Rahman, R. A., and Dean, F. (2013). Challenges and Solutions in Islamic Microfinance. Humanomics, Vol. 29(4): 293-306.

Reyes, G. P. (2010).Financial Inclusion Indicators for Developing Countries, The Peruvian Case. Peru: Superintendency of Banking.

Rhyne, E. (2009). Microfinance for Bankers and Investors, Understanding the Opportunity at the Bottom of the Pyramid. New York: McGraw-Hill.

Robinson, M. S. (2001). The Microfinance Revolution, Sustainable Finance for the Poor. Washington DC: World Bank.

Rokhman, W. (2013). Baitul Mal Wat Tamwil (BMT) and Poverty Alleviation. Qudus International Journal of Islamic Studies, Vol. 1(2): 181-196.

Rosenberg, R. (2009). Measuring Results of Microfinance Institutions, Minimum Indicators that Donors and Investors Should Track. Washington DC: The World Bank.

Rusydiana, A. S., and Devi, A. (2013). Challenges in Developing Baitul Maal Wat Tamwil (BMT) in Indonesia Using Analytical Network Process (ANP). Business and Management Quarterly Review, Vol. 4(2): 51-62.

Saaty, TL. (2005), Theory and Applications of the Analytic Network Process, Decision Making with Benefits, Opportunities, Costs and Risks. Pittsburgh: RWS Publications.

Saaty, TL and Vargas, LG. (2006). Decision Making with the Analytic Network Process, Economic, Political, Social and Technological Applications with Benefits, Opportunities, Costs and Risks. New York: Springer Science + Business Media.

Saha, S. (2011). Provision of Health Services for Microfinance Clients, Analysis of Evidence from India. International Journal Medical Public Health, Vol. 1(1):1-5.

Sarma, M., andPais, J. (2008).Financial Inclusion and Development, A Cross Country Analysis. New Delhi: Madras Schools of Economics.

Seibel, H. D. (2005). Islamic Microfinance in Indonesia. Sector Project Financial Systems Development. Eschborn: Deutsche Gesellschaftfür Technische Zusammenarbeit.

Shirazi, N. S. (2012). Targeting and Socio-Economic Impact of Microfinance, A Case Study of Pakistan (Working Paper 1433-02). Islamic Research and Training Institute.

Stauffenberg, D. V., et al. (2003). Performance Indicators for Microfinance Institutions, Technical Guide. Washington DC: Inter-American Development Bank.

Tamanni, L., and Liu, F. H. (2015, September). Islamic Microfinance Institutions, Pro-Poor or Profit?. Paper presented at the Inaugural Symposium on Islamic Finance, World Bank and Islamic Development Bank, Istanbul.

Tamanni, L., and Mukhlisin, M. (2013). Sakinah Finance, Solusi Mudah Mengatur Keuangan Keluarga Islami. Solo: Tinta Medina.

Tucker, M. (2001). Financial Performance of Selected Microfinance Institutions, Benchmarking Progress to Sustainability. Journal of Microfinance, Vol. 3(2): 107-123.

Widiarto, I., and Emrouznejad, A. (2015). Social and Financial Efficiency of Islamic Microfinance Institutions, A Data Development Analysis Application. Socio-Economic Planning Sciences, Vol. 50: 1-17.

World Bank. (2013). Inclusion Matters, The Foundation for Shared Prosperity (Advance edition). Washington DC: World Bank.

Yanah. (2014). Strategi Pengentasan Kemiskinan di Indonesia melalui Sinergi antara Bank Syariah dan BAZNAS. Jurnal Ekonomi, Vol. 2(3): 1-33.

Yunus, M. (2004). Grameen Bank, Microcredit, and Millenium Development Goals. Economic and Political Weekly, Vol. 39(36): 4077-4085.

Yuqing, C. (2007). Can Microfinance Change the Lives of the Poor in

China? (Reuters Fellowship Paper). Oxford University.

Zada, N., and Saba, I. (2013). The Potential Use of Qard Hasan in Islamic Microfinance”, ISRA International Journal of Islamic Finance, Vol. 5(2): 153-162.

Zeller, Z., and Meyer, R. L. (2002).The Triangle of Microfinance, Financial Sustainability, Outreach and Impact. London: The John Hopkins University Press.

Downloads

Published

2018-07-27

How to Cite

Ascarya, ., Rahmawati, S., & Tanjung, H. (2018). Design the Roadmap of Holistic Financial Inclusion for Baitul Maal wat Tamwil. Tazkia Islamic Finance and Business Review, 12(1). https://doi.org/10.30993/tifbr.v12i1.112

Issue

Section

Articles

License

Tazkia Islamic Finance and Business Review (TIFBR) is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website), as it can lead to productive exchanges, as well as earlier and greater citation of published work (See the Effect of Open Access).