Optimization Strategy of Laku Pandai Policy in Islamic Bank: A Case Study

DOI:

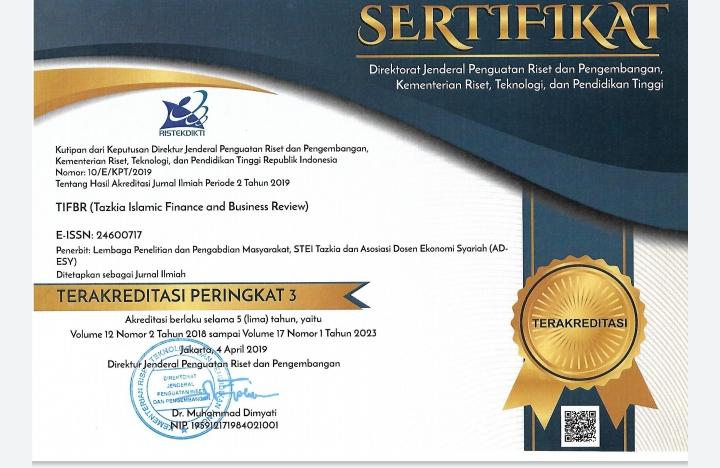

https://doi.org/10.30993/tifbr.v11i2.140Keywords:

Laku Pandai, SWOT, AHPAbstract

Laku Pandai is a program providing banking services and/or other financial services through cooperating with other parties (bank agents) and supported by the usage of modern facilities to increase and expand any accesses to financial services. Laku Pandai is quite effective and efficient if its implementation and optimization are conducted by the banks that are eager in expanding their services in lower average cost. As for how it is, its significant development then triggered BRI Sharia to participate. However, Financial Services Authority thinks that conventional banking is not yet optimal, so it comes up with an argumentative assumption on sharia banking if it successfully implements the program. The purpose of this study is to determine appropriate strategies for optimizing Laku Pandai outputs in sharia banking using SWOT and AHP analysis. SWOT analysis is used to determine internal and external factors related to application of the output, while AHP is used to capture the best precise strategy. The result of the research shows that the main output of Laku Pandai is to successfully reach unbanked people with the exact alternative that is by improving marketing and promotion, improving socialization and education to society, improving agent quality and establishing vision and mission.References

Al Arif, M. N. R. (2012). Lembaga Keuangan Syariah Suatu Kajian Teoritis Praktis. Pustaka Setia. Bandung.

Anggraeni, N. (2015). Pengaruh Layanan 3 in 1 Maslahah (Branchless Banking) terhadap Pertumbuhan Dana Pihak Ketiga (DPK) dan Efisiensi Biaya Operasional Bank pada PT. Bank BJB Syariah. Doctoral dissertation, Fakultas Syariah UNISBA.

Ascarya and Yumanita, D. (2010). Determinan dan Persistensi Margin Perbankan Konvensional dan Syariah di Indonesia. Working paper series No.WP/10/04. Pusat Pendidikan dan Studi Kebanksentralan Bank Indonesia.

Ascarya. (2011). The Persistence of Low Profit and Loss Sharing Financing in Islamic Banking: The Case of Indonesia. Review of Indonesian Economic and Business Studies, Vol. 1.

Asri, D.A. (2010). Strategi Kebijakan Pembangunan Daerah Kabupaten Klaten : Pendekatan Analisis SWOT dan AHP. Tesis UI Program Magister Perencanaan dan Kebijakan Publik. Jakarta.

Bank Indonesia. (2015). Laporan Perekonomian Indonesia 2015 “Bersinergi Mengawal stabilitas, Mewujudkan Reformasi Struktural. ISSN 0522-2572.

Departemen Penelitian dan Pengaturan Perbankan. (2015). Seputar Informasi Mengenai Layanan Keuangan Tanpa Kantor dalam Rangka Keuangan Inklusif. Otoritas Jasa Keuangan.

Heene, A and Sebastian D. (2015). Manajemen Strategik Keorganisasian Publik. Cetakan Kedua. PT Refika Aditama, Bandung.

Heri, S. (2015). Bank dan Lembaga Keuangan Syariah Deskripsi dan Ilustrasi. Edisi Ke 4 cet ke-3. Ekonisia, Yogyakarta.

Hubeis, M. and M. Najib. (2014). Manajemen Strategik dalam Pengembangan Daya Saing Organisasi. PT Elex Media Komputindo Kompas Gramedia, Jakarta.

Ignacio, M. (2012). Branchless and Mobile Banking Solutions for the Poor: A Survey of the Literature. Innovations, Vol. 6(4).

Jeni, W. (2009). Strategi Pengembangan Kawasan Industri Kecil Berbasis Komoditas Unggulan (Studi Kasus Kawasan Sentra Industri Keripik Kota Bandar Lampung). Tesis, Univesitas Indonesia. Jakarta.

Junarti, and Saiful, A. (2016). Faktor-Faktor yang Mempengaruhi Peningkatan Dana Pihak Ketiga Perbankan Syariah (Studi Kasus pada Bank Umum Syariah Periode 2010-2014). Konferensi Islamic-EBD 2016.

Karim, A. (2012). Bank Islam Analisis Fiqih dan Keuangan. Edisi Kempat. PT Raja Grasindo Persada, Jakarta.

Otoritas Jasa Keuangan. (2015). Seputar Informasi Mengenai Layanan Keuangan Tanpa Kantor dalam Rangka Keuangan Inklusif (LAKU PANDAI). Departemen Penelitian dan Pengaturan Perbankan.

Otoritas Jasa Keuangan. Penjelasan atas POJK Nomor 19/POJK.03/2014 tentang Layanan Keuangan Tanpa Kantor Dalam Rangka Keuangan Inklusif, hal 1.

Philip, K. (2002). Manajemen Pemasaran Edisi Millenium 1. Translated by Hendra Teguh and Ronny A. Rusli. PT. Prenhalindo, Jakarta.

Prasetya, I. (2004). Metode Penelitian. Universitas Terbuka, Jakarta.

Prasetya, I. (2006). Penelitian Kualitatif and Kuantitatif Untuk Ilmu-Ilmu Sosial. Departemen Ilmu Adminstrasi FISIP UI, Jakarta.

Pungki, P. (2013). Branchless Banking Setelah Multilicense: Ancaman Atau Kesempatan Bagi Perbankan Nasional. Delivered in order to comply one of Bank Indonesia Leadership Staff School Requirements (SESPIBI).

Saaty, T.L. and Vargas L.G. (2006). Decision Making with the Analytic Network Process Economic, Political, Social and Technological Applications with Benefits, Opportunities, Cost and Risk. Springer International Series.

Saiful, A. and Kenji, W. (2011). Performance Comparison of Multiple Linear Regression and Artificial Neural Networks in Predicting Depositor

Return of Islamic Bank. 2010 International Conference on E-business, Management and Economics.

Saiful, A. and Rifki, I. (2011). Robustness Analysis of Artificial Neural Networks and Support Vector Machine in Making Prediction. Parallel and Distributed Processing with Applications (ISPA). IEEE 9th International Symposium on IEEE.

Saiful, A. and Yoshiki M. (2011). Comparing Accuracy Performance of ANN, MLR, and GARCH Model in Predicting Time Deposit Return of Islamic Bank. International Journal of Trade, Economics and Finance, Vol. 2 (1): 44-51.

Sugiyono. (2012). Metode Penelitian Kuntitatif, Kualitatif dan R&D. Alfabeta, Bandung

Tanjung, H and Devi, A. (2013). Metodologi Penelitian Ekonomi Islam. Gramatika Publishing, Bekasi.

Wibowo, P. W. (2013). Branchless Banking Setelah Multilicense: Ancaman atau Kesempatan Bagi Perbankan Nasional. Bank Indonesia, Jakarta.

Anggraeni, N. (2015). Pengaruh Layanan 3 in 1 Maslahah (Branchless Banking) terhadap Pertumbuhan Dana Pihak Ketiga (DPK) dan Efisiensi Biaya Operasional Bank pada PT. Bank BJB Syariah. Doctoral dissertation, Fakultas Syariah UNISBA.

Ascarya and Yumanita, D. (2010). Determinan dan Persistensi Margin Perbankan Konvensional dan Syariah di Indonesia. Working paper series No.WP/10/04. Pusat Pendidikan dan Studi Kebanksentralan Bank Indonesia.

Ascarya. (2011). The Persistence of Low Profit and Loss Sharing Financing in Islamic Banking: The Case of Indonesia. Review of Indonesian Economic and Business Studies, Vol. 1.

Asri, D.A. (2010). Strategi Kebijakan Pembangunan Daerah Kabupaten Klaten : Pendekatan Analisis SWOT dan AHP. Tesis UI Program Magister Perencanaan dan Kebijakan Publik. Jakarta.

Bank Indonesia. (2015). Laporan Perekonomian Indonesia 2015 “Bersinergi Mengawal stabilitas, Mewujudkan Reformasi Struktural. ISSN 0522-2572.

Departemen Penelitian dan Pengaturan Perbankan. (2015). Seputar Informasi Mengenai Layanan Keuangan Tanpa Kantor dalam Rangka Keuangan Inklusif. Otoritas Jasa Keuangan.

Heene, A and Sebastian D. (2015). Manajemen Strategik Keorganisasian Publik. Cetakan Kedua. PT Refika Aditama, Bandung.

Heri, S. (2015). Bank dan Lembaga Keuangan Syariah Deskripsi dan Ilustrasi. Edisi Ke 4 cet ke-3. Ekonisia, Yogyakarta.

Hubeis, M. and M. Najib. (2014). Manajemen Strategik dalam Pengembangan Daya Saing Organisasi. PT Elex Media Komputindo Kompas Gramedia, Jakarta.

Ignacio, M. (2012). Branchless and Mobile Banking Solutions for the Poor: A Survey of the Literature. Innovations, Vol. 6(4).

Jeni, W. (2009). Strategi Pengembangan Kawasan Industri Kecil Berbasis Komoditas Unggulan (Studi Kasus Kawasan Sentra Industri Keripik Kota Bandar Lampung). Tesis, Univesitas Indonesia. Jakarta.

Junarti, and Saiful, A. (2016). Faktor-Faktor yang Mempengaruhi Peningkatan Dana Pihak Ketiga Perbankan Syariah (Studi Kasus pada Bank Umum Syariah Periode 2010-2014). Konferensi Islamic-EBD 2016.

Karim, A. (2012). Bank Islam Analisis Fiqih dan Keuangan. Edisi Kempat. PT Raja Grasindo Persada, Jakarta.

Otoritas Jasa Keuangan. (2015). Seputar Informasi Mengenai Layanan Keuangan Tanpa Kantor dalam Rangka Keuangan Inklusif (LAKU PANDAI). Departemen Penelitian dan Pengaturan Perbankan.

Otoritas Jasa Keuangan. Penjelasan atas POJK Nomor 19/POJK.03/2014 tentang Layanan Keuangan Tanpa Kantor Dalam Rangka Keuangan Inklusif, hal 1.

Philip, K. (2002). Manajemen Pemasaran Edisi Millenium 1. Translated by Hendra Teguh and Ronny A. Rusli. PT. Prenhalindo, Jakarta.

Prasetya, I. (2004). Metode Penelitian. Universitas Terbuka, Jakarta.

Prasetya, I. (2006). Penelitian Kualitatif and Kuantitatif Untuk Ilmu-Ilmu Sosial. Departemen Ilmu Adminstrasi FISIP UI, Jakarta.

Pungki, P. (2013). Branchless Banking Setelah Multilicense: Ancaman Atau Kesempatan Bagi Perbankan Nasional. Delivered in order to comply one of Bank Indonesia Leadership Staff School Requirements (SESPIBI).

Saaty, T.L. and Vargas L.G. (2006). Decision Making with the Analytic Network Process Economic, Political, Social and Technological Applications with Benefits, Opportunities, Cost and Risk. Springer International Series.

Saiful, A. and Kenji, W. (2011). Performance Comparison of Multiple Linear Regression and Artificial Neural Networks in Predicting Depositor

Return of Islamic Bank. 2010 International Conference on E-business, Management and Economics.

Saiful, A. and Rifki, I. (2011). Robustness Analysis of Artificial Neural Networks and Support Vector Machine in Making Prediction. Parallel and Distributed Processing with Applications (ISPA). IEEE 9th International Symposium on IEEE.

Saiful, A. and Yoshiki M. (2011). Comparing Accuracy Performance of ANN, MLR, and GARCH Model in Predicting Time Deposit Return of Islamic Bank. International Journal of Trade, Economics and Finance, Vol. 2 (1): 44-51.

Sugiyono. (2012). Metode Penelitian Kuntitatif, Kualitatif dan R&D. Alfabeta, Bandung

Tanjung, H and Devi, A. (2013). Metodologi Penelitian Ekonomi Islam. Gramatika Publishing, Bekasi.

Wibowo, P. W. (2013). Branchless Banking Setelah Multilicense: Ancaman atau Kesempatan Bagi Perbankan Nasional. Bank Indonesia, Jakarta.

Downloads

Published

2018-06-05

How to Cite

Bakhtiar, J., Anwar, S., & Anisa, F. (2018). Optimization Strategy of Laku Pandai Policy in Islamic Bank: A Case Study. Tazkia Islamic Finance and Business Review, 11(2). https://doi.org/10.30993/tifbr.v11i2.140

Issue

Section

Articles

License

Tazkia Islamic Finance and Business Review (TIFBR) is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website), as it can lead to productive exchanges, as well as earlier and greater citation of published work (See the Effect of Open Access).