Determinant of Repayment Rate of Islamic Mortgate Financing Product

DOI:

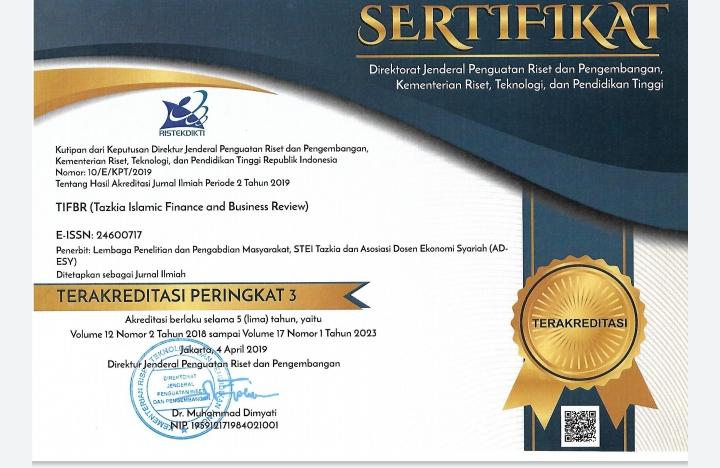

https://doi.org/10.30993/tifbr.v12i2.149Keywords:

Keyword, Islamic Bank, Mortgage Financing, Logistic Regression, Repayment RateAbstract

Penelitian ini bertujuan untuk menganalisis faktor penentu tingkat pembayaran kembali pembiayaan perumahan di perbankan syariah. Penelitian ini menggunakan model analisis regresi logistik; dengan variabel dependen yang digunakan adalah tingkat kolektabilitas sedangkan variabel bebasnya adalah usia, jumlah anggota keluarga, tingkat pendidikan, rekening bank, saldo tabungan, rekam jejak di bank syariah XYZ, rekam jejak di Bank Sentral Indonesia, referensi, status perumahan, lama tinggal, jenis perusahaan, posisi di tempat kerja, lama kerja, pendapatan, lama pembiayaan, kemampuan pembayaran kewajiban, rekomendasi penilaian, ukuran bangunan, tujuan pembiayaan, dan rasio pembiayaan terhadap agunan. Hasilnya menunjukkan bahwa hanya lima determinan yang mampu mempengaruhi tingkat pembayaran pembiayaan KPR syariah atau KPR di bank syariah XYZ di Jakarta, Bogor, Depok, Tangerang, Bekasi, dan Cilegon pada periode tahun 2014-2016. Faktor-faktor penentu tersebut adalah rekam jejak di Bank Syariah XYZ dan Bank Sentral Indonesia, jenis perusahaan, lama pembiayaan, dan kemmampuan pembayaran kewajiban. Pada saat yang sama, rekam jejak di Bank Sentral Indonesia dan lamanya pembiayaan memiliki efek negatif terhadap tingkat pengembalian KPR Islam.References

Annual Report. (2016). Accelerated Performance for Sustainable Growth. BRIIslamich, Jakarta.

Arifin, Z. (2015). Musharaka Financing Risk Analysis of Customer Financing Return (Study at PT BPR Islamic Bumi Rinjani Probolinggo). Journal of Business Administration, Universitas Brewijaya Malang, Vol. 28 (2): 2-5.

Bank Indonesia Regulation. (2016). Loan to Value Ratios for Property Loans, Financing to Value Ratios for Pretest Financing, and Down Payment for Credit or Motor Vehicle Financing. Bank Indonesia.

Fatmasari, N, (2011). Analysis of Conventional Bank Mortgage Financing System and KPRS Financing of Islamic bank (Case Study of Bank BTN with Bank Muamalat). Universitas Negeri Surabaya.

Ghozali, I. (2012). Application of Multivariate Analysis with IBM SPSS 20. Semarang: Publisher Agency.

Handoyo, M. (2009). Factors that Affect the Repayment Rate of Islamic Financing for SMEs Agribusiness on KBMT Wihdatul Ummah Bogor City. Thesis. Bogor: Faculty of Economics and Management, Bogor Agricultural University.

Haris, H. (2007), Housing Financing (An Islamic Banking Financing Innovation). Journal of Islamic Economics, La Riba, Vol. 1 (1).

Hasibuan, R. (2010). Analysis of Factors Affecting the Return on Bad Credit in Rural Business Loan (KUPEDES) Related to Agribusiness Sector (Case of PT Bank Rakyat Indonesia, Tbk Cijeruk Unit, Bogor Regency, West Java). Thesis. Bogor Agricultural University.

Krisnawati, et al. (2009) Perception Analysis Analysis of Housing Loan Products (KPR) XYZ Bank Bogor Branch. Journal of Management & Agribusiness, Vol 6 (1).

Kuncoro, M. (2001). Quantitative Methods of Theory and Application for Business and Economics. Yogyakarta: AMP YKPN.

Nabilah, S. (2015). Risk Analysis and Factors Affecting the Return Rate of Islamic Financing in the Agricultural Sector (Case Study of BMT As Salam, Kramat Demak). Thesis. Bogor Agricultural University.

Racmat, M. Z. (2011). Analysis Affecting the Return of Financing of Agribusiness at Islamic Commercial Bank (Case on BMI Depok Branch Depok). Thesis. Bogor Agricultural University.

Safitri, D. (2013). Evaluation Analysis of Credit Scoring Model on Financing Quality of KPR FLPP Financing (Liquidity Facility for Housing Financing) (Case Study at Islamic bank X). Thesis: TAZKIA University College of Islamic Economics.

Arifin, Z. (2015). Musharaka Financing Risk Analysis of Customer Financing Return (Study at PT BPR Islamic Bumi Rinjani Probolinggo). Journal of Business Administration, Universitas Brewijaya Malang, Vol. 28 (2): 2-5.

Bank Indonesia Regulation. (2016). Loan to Value Ratios for Property Loans, Financing to Value Ratios for Pretest Financing, and Down Payment for Credit or Motor Vehicle Financing. Bank Indonesia.

Fatmasari, N, (2011). Analysis of Conventional Bank Mortgage Financing System and KPRS Financing of Islamic bank (Case Study of Bank BTN with Bank Muamalat). Universitas Negeri Surabaya.

Ghozali, I. (2012). Application of Multivariate Analysis with IBM SPSS 20. Semarang: Publisher Agency.

Handoyo, M. (2009). Factors that Affect the Repayment Rate of Islamic Financing for SMEs Agribusiness on KBMT Wihdatul Ummah Bogor City. Thesis. Bogor: Faculty of Economics and Management, Bogor Agricultural University.

Haris, H. (2007), Housing Financing (An Islamic Banking Financing Innovation). Journal of Islamic Economics, La Riba, Vol. 1 (1).

Hasibuan, R. (2010). Analysis of Factors Affecting the Return on Bad Credit in Rural Business Loan (KUPEDES) Related to Agribusiness Sector (Case of PT Bank Rakyat Indonesia, Tbk Cijeruk Unit, Bogor Regency, West Java). Thesis. Bogor Agricultural University.

Krisnawati, et al. (2009) Perception Analysis Analysis of Housing Loan Products (KPR) XYZ Bank Bogor Branch. Journal of Management & Agribusiness, Vol 6 (1).

Kuncoro, M. (2001). Quantitative Methods of Theory and Application for Business and Economics. Yogyakarta: AMP YKPN.

Nabilah, S. (2015). Risk Analysis and Factors Affecting the Return Rate of Islamic Financing in the Agricultural Sector (Case Study of BMT As Salam, Kramat Demak). Thesis. Bogor Agricultural University.

Racmat, M. Z. (2011). Analysis Affecting the Return of Financing of Agribusiness at Islamic Commercial Bank (Case on BMI Depok Branch Depok). Thesis. Bogor Agricultural University.

Safitri, D. (2013). Evaluation Analysis of Credit Scoring Model on Financing Quality of KPR FLPP Financing (Liquidity Facility for Housing Financing) (Case Study at Islamic bank X). Thesis: TAZKIA University College of Islamic Economics.

Downloads

Published

2018-09-04

How to Cite

El Baqiy, H. M., & Ardiansyah, F. (2018). Determinant of Repayment Rate of Islamic Mortgate Financing Product. Tazkia Islamic Finance and Business Review, 12(2). https://doi.org/10.30993/tifbr.v12i2.149

Issue

Section

Articles

License

Tazkia Islamic Finance and Business Review (TIFBR) is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website), as it can lead to productive exchanges, as well as earlier and greater citation of published work (See the Effect of Open Access).