The Contribution of Sukuk Placement and Securities to The Islamic Bank Profitability

DOI:

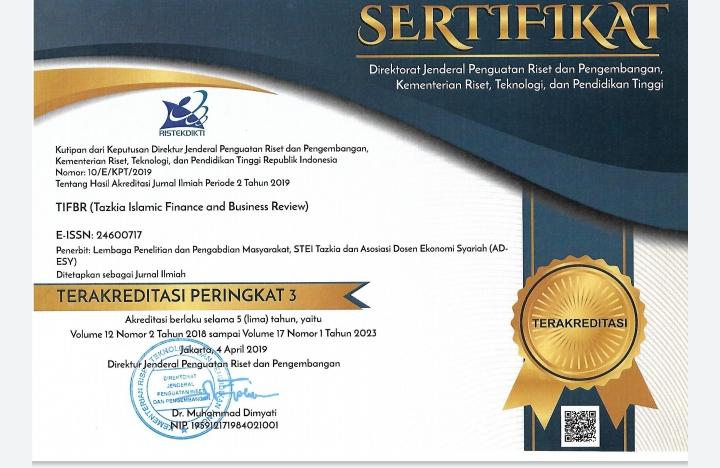

https://doi.org/10.30993/tifbr.v13i2.184Keywords:

Islamic banking, government sukuk, fund placements in Bank Indonesia, non-government sukuk, ROAAbstract

The purpose of this study was to determine the effect of the placement of Islamic bank funds on government assets, the placement of Islamic bank funds at the central bank and the influence of Islamic bank funds on non-government assets on the profitability of Islamic banks. The method is quantitative with a multiple regression statistical model and the Stata version 13 as the statistical software. Based on data processing on research variables it was found that investment in state sukuk had a negative and significant effect on return on assets. Furthermore, the variable investment in securities in Bank Indonesia instruments has a positive and significant impact, while investment in sukuk corporates has a positive effect that is not significant. Therefore Sharia Banks must be able to select investment options in placing their excess funds to maintain bank reputation and performance so that public trust increases with the functions and contributions of Islamic banks.

References

Alamsyah, H., Zulverdi, D., Gunadi, I., Idris, R. Z., & Pramono, B. (2005). Banking disintermediation and its implication for monetary policy: the case of Indonesia. Buletin Ekonomi Moneter dan Perbankan, 7(4), 499-522.

Anuar, A. S., Bahari, Z., Doktoralina, C. M., Indriawati, F., & Nugroho, L. (2019). The Diversity Of Waqf Implementations for Economic Development in Higher Education. IKONOMIKA, 4(1), 13-34.

Arafah, W., & Nugroho, L. (2016). Maqhashid sharia in clean water financing business model at Islamic bank. International Journal of Business and Management Invention, 5(2), 22-32.

Archer, S., & Haron, A. (2013). Operational risk exposures of Islamic banks. Islamic Finance: The New Regulatory Challenge, 133-52.

Arndt, H. W. (1979). Monetary policy instruments in Indonesia. Bulletin of Indonesian Economic Studies, 15(3), 107-122.

Barber, B. M., Lehavy, R., & Trueman, B. (2007). Comparing the stock recommendation performance of investment banks and independent research firms. Journal of financial economics, 85(2), 490-517.

Bathaluddin, M. B., & Wahyu, A. W. (2012). The Impact of Excess Liquidity on Monetary Policy. Bulletin of Monetary Economics and Banking, 14(3), 1-23.

Bikker, J. A., & Hu, H. (2002). Cyclical patterns in profits, provisioning and lending of banks and procyclicality of the new Basel capital requirements. PSL Quarterly Review, 55(221).

Chotib, A., & Utami, W. (2014). Studi Kinerja PT BNI Syariah Sesudah Pemisahan (Spin Off) dari PT Bank BNI (Persero) TBK. Akuntabilitas, 7(2), 94-108.

Coleman, S. (2000). Access to capital and terms of credit: A comparison of men-and women-owned small businesses. Journal of small business management, 38(3), 37.

DeYoung, R., Goldberg, L. G., & White, L. J. (1999). Youth, adolescence, and maturity of banks: Credit availability to small business in an era of banking consolidation. Journal of Banking & Finance, 23(2-4), 463-492.

Dugar, A., & Nathan, S. (1995). The effect of investment banking relationships on financial analysts' earnings forecasts and investment recommendations. Contemporary Accounting Research, 12(1), 131-160.

Elton, E. J., Gruber, M. J., Agrawal, D., & Mann, C. (2001). Explaining the rate spread on corporate bonds. the journal of finance, 56(1), 247-277.

Firdaus, M. F., & Hosen, M. N. (2013). Efisiensi bank umum syariah menggunakan pendekatan two-stage data envelopment analysis. Buletin Ekonomi Moneter dan Perbankan, 16(2), 150-167.

Gatev, E., Schuermann, T., & Strahan, P. E. (2007). Managing bank liquidity risk: How deposit-loan synergies vary with market conditions. The Review of Financial Studies, 22(3), 995-1020.

Ghozali, I. (2006). Aplikasi analisis multivariate dengan program SPSS. Badan Penerbit Universitas Diponegoro.

Gilani, H. (2015). Exploring the ethical aspects of Islamic banking. International Journal of Islamic and Middle Eastern Finance and Management, 8(1), 85-98.

Hassan, A. (2009). The global financial crisis and Islamic banking. UK: The Islamic Foundation, UK.

Hassan, M. K., & Kayed, R. N. (2009). The global financial crisis, risk management and social justice in Islamic finance. Risk Management and Social Justice in Islamic Finance.

Ismal, R. (2010). Assessment of liquidity management in Islamic banking industry. International Journal of Islamic and Middle Eastern Finance and Management, 3(2), 147-167.

Jobst, A., Kunzel, P., Mills, P., & Sy, A. (2008). Islamic bond issuance: what sovereign debt managers need to know. International Journal of Islamic and Middle Eastern Finance and Management, 1(4), 330-344.

Masyita, D. (2015). Why Do People See a Financial System as a Whole Very Important?. Journal of Islamic Monetary Economics and Finance, 1(1), 79-106.

Köhler, M. (2015). Which banks are more risky? The impact of business models on bank stability. Journal of Financial Stability, 16, 195-212.

Loutskina, E. (2011). The role of securitization in bank liquidity and funding management. Journal of Financial Economics, 100(3), 663-684.

Nugroho, L., & Husnadi, T. C. (2017). Maslahah and Strategy to Establish a Single State-Owned Islamic Bank in Indonesia. Tazkia Islamic Finance and Business Review, 10(1).

Nugroho, L., Utami, W., Sukmadilaga, C., & Fitrijanti, T. (2017). The Urgency of Allignment Islamic Bank to Increasing the Outreach (Indonesia Evidence). International Journal of Economics and Financial Issues, 7(4), 283-291.

Ro’aina, N. (2015). Pengaruh Religiusitas terhadap Keputusan menjadi Nasabah Bank Syariah Mandiri KCP Wonocolo Surabaya (Doctoral dissertation, UIN Sunan Ampel Surabaya).

Setiawan, A. B. (2006). Perbankan Syariah; Challenges dan Opportunity Untuk Pengembangan di Indonesia. Jurnal Kordinat, 8(1).

Setiawan, C., & Putri, M. E. (2013). Non-performing financing and bank efficiency of Islamic banks in Indonesia. Journal of islamic finance and Business research, 2(1), 58-76.

Shafique, A., Faheem, M. A., & Abdullah, I. (2012). Impact of global financial crises on the Islamic banking system: Analysis of Islamic financial system during financial crunch 2008. Arabian Journal of Business and Management Review (OMAN Chapter), 1(9), 124.

Siswanti, I. (2015). Pengaruh Pengetahuan, Agama, Iklan/Informasi, Dan Pengalaman Mahasiswapai Stain Salatiga Tentang Sistem Perbankan Syariah Terhadap Minat Menabung Di Bank Syariah (Doctoral dissertation, IAIN Salatiga).

Smith Jr, C. W. (1986). Investment banking and the capital acquisition process. Journal of Financial Economics, 15(1-2), 3-29.

Sudarsono, H. (2009). Dampak krisis keuangan global terhadap perbankan di indonesia: perbandingan antara bank konvensional dan bank syariah. La_Riba, 3(1), 12-23.

Usman, B., Syofyan, S., & Nugroho, L. (2018). Foreign Bank Penetration And Its Impact On Banking Industries. Eurasian Journal of Economics and Finance, 6(1), 64-83.

Utami, S. S. (2013). Analisis Perbandingan kinerja keuangan perbankan Syariah dengan perbankan Konvensional. Jurnal Ekonomi dan kewirausahaan, 13(1).

Wajdi Dusuki, A. (2008). Banking for the poor: the role of Islamic banking in microfinance initiatives. Humanomics, 24(1), 49-66.

Wibowo, E. S., & Syaichu, M. (2013). Analisis pengaruh suku bunga, inflasi, car, bopo, npf terhadap profitabilitas bank syariah. Diponegoro Journal of Management, 2(2), 10-19.

On line references:

Bank Syariah Mandiri Annual Report, (2016) available online at: https://www.syariahmandiri.co.id/tentang-kami/company-report/annual-report

Downloads

Published

How to Cite

Issue

Section

License

Tazkia Islamic Finance and Business Review (TIFBR) is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website), as it can lead to productive exchanges, as well as earlier and greater citation of published work (See the Effect of Open Access).